PDF Asset rotational

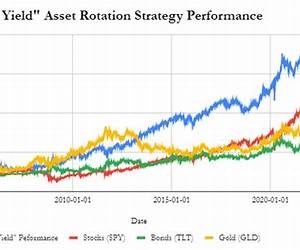

This book is a simple and easy to read guide on how to allocate assets in your portfolio I really like how the idea is so simple to follow and with the small adjustments made to the asset rotation strategy it was able to easily outperformed the SP500 benchmark with much lesser risk when indexed to 1990. Book Asset rotational However there was a huge caveat that was not taken into account that has potential to cut short our returns That is how is one able to ignore the trading fees with the vast amount of rebalancing required every month And the fact that the author didn t even acknowledge this is pretty bad At the least they should have stated this assumption Nonetheless if you happen to have zero commission with your brokerage I would think this book might be worth checking out to understand their investment strategy 9781118779040

An all weather tactical approach to asset management utilizing Exchange Traded Funds ETFs In Asset Rotation portfolio management pioneer Matthew P Erickson demonstrates a time tested approach to asset management that has worked throughout the history of capital markets in good times and bad Providing investors with strong participation in rising markets but importantly with a discipline to reduce participation in prolonged declines Over time this revolutionary approach has yielded superior returns with significantly reduced levels of risk providing the engine for true long term sustainable growth.

Asset Rotation kindle store The investment world as we know it has changed and the paradigm has shifted What has worked in the past may no longer work in the future No longer may bonds be regarded as a safe haven asset class as for the first time in generations investors in fixed income face losses as interest rates rise from historical all time lows For those adhering to a conventional Modern Portfolio Theory based investment approach to asset management what was once regarded as safe and stable may very well soon become our greatest impediment.

Kindle Asset rotational Asset Rotation provides investors with a practical solution for today s real world problems This tactical approach to asset management provides us with concrete proof that there is indeed a better way.

EBook Asset rotation lock Presents an easy to understand price momentum based approach to investing Illustrates the benefits of asset rotation Offers a systematic approach for securing a sound financial future Provides further insights as to how to customize your own asset rotation portfolio Matthew Erickson gives investors a hands on resource for how to navigate an increasingly difficult investment landscape by providing them with keen insights into the most rapidly growing segment of the investment markets Asset Rotation The Demise of Modern Portfolio Theory and the Birth of an Investment Renaissance

..

Asset Rotation bookkeeping We are standing on the precipice of an Investment Renaissance What was previously impossible is now possible Find out how

.. Asset Rotation bookkeeping We are standing on the precipice of an Investment Renaissance What was previously impossible is now possible Find out how

.. Asset Rotation bookkeeping We are standing on the precipice of an Investment Renaissance What was previously impossible is now possible Find out how